Corporate Governance Statements

LMC acknowledges the importance of the Corporate Governance as an application of the best management practices that are directed towards achievement of corporate values, goals and objective and enhancing shareholders value coupled with high transparency and corporate responsibility.

The Board conducted a thorough review of the Bank's high level policies for corporate governance, internal control, risk management and compliance with the latest regulations and guidelines of the Central Bank of Bahrain (CBB).

For more details, please go to Annual Report

The Board of Directors

The Board is nominated by the shareholders of the Bank in accordance with

the provisions of the Article of Association of the Bank and CBB approvals. The

Board has eight directors representing the interest of the Bank and it is highly

responsible for the Management and its performance and provides directions and

applies policies in order to ensure strategic guidance of the Bank.

Board's Responsibilities

The Board of Directors is delegated with the responsibility to oversee that the Bank in carrying out its duties and enhance the effectiveness of the Board. It serves in monitoring the Management to ensure that the policies and processes are in the right place to show that it is operating effectively and taking the responsibility with regard to the financial report, internal control and the process of monitoring compliance with applicable laws and regulations. Each Director is appointed for a three years term renewable at an Annual General Meeting of the shareholders of the Bank, subject to CBB approval.

Board Meetings

In accordance with the applicable CBB regulations and the Article of Association

of the Bank, the Board of Directors is required to meet at least four times per

year. On a regular basis the Board have close contact with Management and are

required to act within their given authority for the benefit of the Bank.

Board Committees

Board of Directors

Objective:

The Board of Directors is responsible for overseeing the management and

business affairs of the Bank and making all major policy decisions of the Bank.

The ultimate responsibility of preparation and approval of financial statements

lies with the Directors.

Chairman:

Members:

- Mr. Ameer A.Ghani

- Dr. Adnan Chilwan

- Mr. Amer Sadiq

- Dr. Mohamed Ali Chatti

- Mr. Ali Mamoun

- Mr. Khalid Al Shami

- Mr. Hamed Y. Mashal

Audit Committee

Objective:

Assists the Board in discharging its oversight responsibilities relating to

the integrity of the Bank’s financial statements and financial reporting process

and the Bank’s systems of internal accounting and financial controls, the annual

independent audit of the Bank’s financial statements and all matters related to

external and internal auditors, compliance by the Banks with legal and

regulatory requirements and compliance with the Bank’s code of conduct.

Chairman:

Members:

- Dr. Adnan Chilwan

- Dr. Mohamed Ali Chatti

- Mr. Hamed Y. Mashal

Risk and Compliance Committee

Objective:

Assist the Board in discharging its oversight responsibilities related to

establishment of an effective Risk Management and Compliance Framework.

Chairman:

Members:

- Mr. Ameer A. Ghani

- Mr. Khalid Al Shami

- Mr. Ali Mamoun

Nomination, Remuneration & Corporate Governance Committee

Objective:

The Nomination Remuneration & Corporate Governance Committee enables the

Board to fulfill its responsibilities in setting the appropriate composition and

evaluating the performance of the Board, individual directors and senior

management. It is also responsible for the remuneration policies. The committee

also takes a leadership role in shaping corporate governance policies, practices

and leads the Board in its annual review of the Board’s performance and

recommends to the Board of Directors, candidates for each committee for

appointment.

Chairman:

Members:

- Mr. Amer Sadiq

- Mr. Ali Mamoun

- Mr. Khalid Al Shami

Sharia Supervisory Board

Objective:

The Shari’a Supervisory Board is an independent body of specialised jurists

in Shari’a compliant banking. The Shari’a Supervisory Board is entrusted with

the duty of directing, reviewing and supervising the activities of the Group in

order to ensure that the Bank is in compliance with Shari’a rules and AAOIFI.

The Fatwas and rulings of the Shari’a Supervisory Board is binding on the Bank.

Member:

- Mr. Shaikh Sayed Mohamed Muheeadin Abduljalil

Management

LMC boasts significant achievements in a span since 2002 with a sound track record, acknowledged by industry leaders around the world. LMC is led by Mr. Bader Al Abbasi, the Acting Chief Executive Officer, and supported by a professional technical and placement team and highly experienced and qualified management team. The management in LMC is responsible for working in an effective manner comprising legal and ethical manners and it aims to increase teamwork, commitment and achieving a successful decision making through its staff and business units in the Bank.

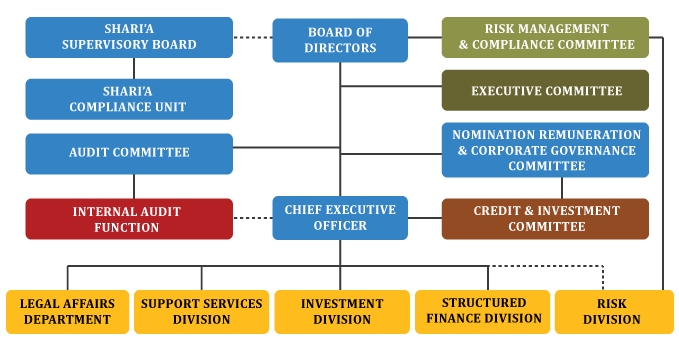

Organizational Structure

As LMC cares about updating and maintaining its track record. The Board has defined the organization structure responsibilities and authorities for the management team and staff where they mainly respond to the changes and needs of the organization during the year and ensure the proper segregation of responsibilities, accountabilities and duties of the staff at all levels.

Compliance

The LMC conducts its business with separate compliance functions in handling its works under the regulatory requirements stipulated by the Central Bank of Bahrain. The Bank complies under many key regulations such as, Shari'a Compliance, Legal Compliance, Financial Accounting Standards and the Central Bank of Bahrain's Regulations and Guidelines.

Code of Business Conduct and Ethics for Members of the Board of Directors

The principal functions of the Group's Board are as follows:

- Reviews and approves long-term strategic plans of the Group;

- Approves the annual budget for the Group and conducts regular review of

achievements against the annual budget;

- Sets clear lines of responsibility and accountability that are communicated

throughout the Group;

- Approves a succession planning policy;

- ensures the implementation of effective internal controls and processes;

- Ensure Shari’a compliance in all aspects of the Group’s operations, products

and activities;

- Establishes and ensures the effective functioning of various Board

Committees;

- Ensures that the operations of the Group are conducted within the framework

of relevant regulations, laws and policies; and

- Approves material transactions outside the normal course of business or in

excess of the limits of approval authority delegated to the Executive Committee.

The new boards were given proper induction and background regarding their rules and responsibilities as a board member and as a member of the board various committees. The board members have approved the following code of business conduct and ethics:

Purpose code of business conduct and ethics:

The primary objectives of the following Code of Business Conduct and Ethics (the "Code") are to enable each Director to focus on areas of ethical risks, to help him/her to recognize and deal with ethical issues, to provide mechanisms for reporting unethical conduct, and to foster a culture of honesty and accountability within the "Group" and each of its Units.

Conflict of interest:

Directors shall disclose to the Board any potential conflict of interest in their activities with other organisations. All Board members and members of executive management must declare to the Board in writing, on an annual basis, all of their other interests in other institutions, whether as a shareholder of five percent (5%) or more of the voting capital of the company, a manager or other form of significant participation. Any decision to enter into transactions, under which Board members or any member of executive management may have a conflict of interest that is material, shall be formally and unanimously approved by the Board.

Board's Responsibility for Disclosure

The Board shall oversee the process of disclosure and communications with internal and external stakeholders. The Board shall ensure that disclosures made by the Group are fair, transparent, comprehensive and timely and reflect the character of the Group and the nature, complexity and risks inherent in the Group's business activities and that they are in compliance with the disclosure requirements set out by the Central Bank of Bahrain.

New product information, Banks new announcement and information related to stakeholders are made available in timely manner through various channels of communication which may include publications, website, direct mailers, electronic mail and local media.

In addition, the Consolidated Financial Statement of at least past 3 years are

available in Financial Highlights section on the website.

Anti-Money Laundering & Combating Financing of Terrorism Statement

Domicile

Liquidity Management Centre B.S.C. (c) ('LMC' or 'the Bank') LMC was established on July 29th, 2002 in the Kingdom of Bahrain as a Bahraini joint stock company with an Islamic Investment Banking license granted by the Central Bank of Bahrain (CBB).

Laws and Supervision

LMC is under the supervision of the Central Bank of Bahrain (CBB) and complies with the Amiri Decree law no. (4) of 2001 (and its amendments Decree Law no. (51) of 2006) with respect to the Prevention & Prohibition of the Money Laundering (the "AML Law") .

The CBB has adopted and is compliant with the forty recommendations plus nine special recommendations issued by the Financial Action Task Force (FATF), which are the international standards for effective anti-money laundering regimes and combating the financing of terrorism.

The Kingdom of Bahrain is a member of the Gulf Cooperation Council (GCC), which is a member of FATF. The Kingdom of Bahrain is also a member of MENAFATF, which is an associate member of FATF.

The Bank's Policies

The Bank will conduct its business in conformity with high ethical standards and will adhere to all laws and regulations pertaining to financial institutions.

The Bank conducts its business in compliance with the following general principles:

- Ensure adherence to the anti-money-laundering and combating the financing of terrorism laws and regulations established by the CBB in accordance with the recommendations of the Financial Action Task Force on Money Laundering & Terrorist Financing as well as policies and procedures laid down by the Bank's Board of Directors.

- Ensure ongoing monitoring of compliance with the Bank's anti-money laundering policies through a combination of internal audit, external audit and regulatory reviews of compliance with relevant anti-money laundering legislation and/or regulations.

- LMC does not conduct business with Shell Banks or other entities with no physical presence. Also, the Bank does not open anonymous accounts.

- The Bank does not provide financial services to a new customer until it has obtained sufficient evidence to satisfactorily establish the customer's identity.

- Always take adequate measures to ensure that the bank does not provide financial services to listed terrorists and/or sanctioned names notified by competent authorities.

- Maintain effective and systematic internal guidelines for establishing and verifying the identity of all customers.

- Record customer identification information and the verification methods and results; and compare information with the CBB provided lists of suspected terrorists.

- The Bank is required by law to file a report in case of any suspicious activity. This report must be sent to the Anti-Money Laundering Directorate at the Ministry of the Interior and copied to the Compliance Directorate at the Central Bank of Bahrain.

- Cooperate fully with law enforcement and regulatory agencies in executing their duties under all applicable laws.

- Provide KYC and anti-money laundering Trainings to all staff to spread awareness among employees as to how to identify suspicious activities, actions to be taken on detection of such activity and on reporting mechanisms.

Client Charter

Introduction

- Liquidity Management Centre B.S.C. (c) recognizes the importance of its clients, as it is our policy to treat them equally and fairly in line with the laws and regulatory agencies in the Kingdom. We aim to maximise client’s value and wealth, and add a new dimension to the Islamic banking industry.

- The Client Charter has been established by the Bank in order to ensure that clients understand that the Bank is obliged to carry out its duties and responsibilities in accordance with the code of business conduct which requires fairness and honesty as demanded by Shari’a.

Terms

- Information about Clients:

- The Bank will not mislead clients or the market through the withholding of material information.

- The Bank is takes necessary measures to ensure that it understands the nature and circumstances of its clients, so that it offers those products most suitable for their needs, as well as offering financing only for Shari’a-compliant projects.

- The Bank ensures that its customers’ businesses and the purpose of any financing provided are consistent with the Shari’a.

- The Bank will gauge the needs of their clients to ensure that the products or services rendered will reasonably meet those needs, and will ensure that any advice to customers is aimed at the customers’ interests and based on adequate standards of research and analysis. Among the methods that are commonly used to gauge clients’ needs are questionnaires and interviews with the clients, a written record being required. Questionnaires must be either completed or signed by the client, and where appropriate a summary of any interview must be signed by the client.

- Customer information shall not be disclosed to anyone outside LMC, other than legitimately to LMC’s regulators, and auditors or lawyers working on a relevant project, unless such disclosure is authorised by the client or required or authorized by the proper legal process or LMC’s regulators. When confidential information is communicated to someone who is entitled to receive it, the information should be marked “confidential” and in cases where such information is being communicated orally, the recipient should be advised that the information is confidential. Irrespective of the mode of dissemination, the recipient should be instructed clearly about restrictions on further dissemination.

- Information to Clients:

- It is the responsibility of the bank to provide its clients full and timely disclosure of material facts relevant to the proposed transaction, their rights and obligations before signing any documents, to avoid any conflicts in the future.

- The Bank will provide clear and truthful information both in any public document issued and to its actual and prospective clients, both during the sales process and in subsequent communications and reports.

- The Bank will ensure that every advertisement is designed to disclose all relevant information to the subject matter.

- The Bank maintains fair treatment of customers through the lifetime of the customer relationships, and ensures that customers are kept informed of important events.

- LMC will not use ‘small print’ to make potentially important information less visible as it’s not compatible with good business conduct and rules, and will be avoided. Likewise, there will be no ‘hidden costs’ in financing products, such as commissions or agency fees that are not disclosed to the client.

- All commission and similar arrangements will be fully disclosed to the subject clients. In selecting a product for recommendation to a client, the overriding criterion must be the benefits to the client and not the attractiveness of the commission to the bank or its representative.

- When introducing new, enhanced, supplementary or replacement services and/or products with cost or potential liability in the future, the bank will provide customers with full particulars of the change at least thirty calendar days prior to the date the change takes effect, and will obtain prior-written consent from each customer. Such notice is to enable the customer to decide whether to accept the new terms or terminate the agreement.

- Conflicts of Interest and of Duty:

- The bank recognises the conflicts of interest between itself and its clients that arise from the type of products it offers, and how to avoid them, or disclose and manage them, bearing in mind its fiduciary duties to investment account holders (IAH) as well as shareholders.

- Good business practice is linked to good governance, particularly with regard to the proper management of conflicts of interest and of duty. The existence of such conflicts must not be hidden, but the bank will be transparent about them while making clear what mechanisms are in place to manage them properly.

- The Bank ensures that their systems of remuneration and compensation do not provide perverse incentives to their management, staff, agents or other representatives that could lead to conflicts of interest.

- In accordance with Article 117 of the CBB Law, LMC will not publish or release information to third parties concerning the accounts or activities of their individual customers, unless:

- Such information is requested by the CBB or by an order from the Courts;

- The release of such information is approved by the customer concerned; or

- It is in compliance with the provision of the law or any international agreements to which the Kingdom is a signatory.

- Terms of Business:

- The Bank will provide their clients with their terms of business, setting out the basis on which the regulated banking services are to be conducted. The terms of business in relation to providing regulated banking services to a customer will take the form of a customer agreement.

- The terms of business includes the rights and obligations of parties to the agreement, as well as other terms relevant to the regulated banking services. The terms of business must include, but are not limited to:

- The licensing status of the bank;

- A statement that the bank is bound by the CBB’s regulation and licensing conditions;

- The bank’s name, address, e-mail and telephone number;

- A statement of the products and services provided by the bank, as permitted by the CBB;

- The total price to be paid by the customer to the bank for its services, or, where an exact price cannot be indicated, the basis for the calculation of the price enabling the customer to verify it;

- Information on any rights the parties may have to terminate the contract early or unilaterally under its terms, including any penalties imposed by the contract in such cases;

- Where appropriate, the customer’s investment objectives;

- Where appropriate, the extent to which the bank will consider the customers’ personal circumstances when considering suitability and the details of such matters that will be taken into account;

- Any conflict of interest disclosure;

- Where appropriate, any disclosure of soft dollar agreements;

- A statement that clearly indicates the following:

- The customer’s right to obtain copies of records relating to his business with the licensee;

- The customer’s record will be kept for 5 years or as otherwise required by Bahrain Law; and

- The name and job title, address and telephone number of the person in the bank to whom any complaint should be addressed (in writing) by the customer.

- The client agreement must be provided in good time prior to providing the regulated banking service.

- Customer Understanding and Acknowledgement:

- The Bank will not enter into a customer agreement unless they have taken reasonable care to ensure that their customer has had a proper opportunity to consider the terms.

- The Bank will obtain their customer’s consent to the terms of the customer agreement as evidenced by a signature or an equivalent mechanism.

- The customer agreement must contain the signatures of both parties to the agreement. If the agreement is signed by only the customer (in case it is in the form of an application), copies of the signed agreement must be provided by the bank to the customer.

- Risks:

- The Bank discloses adequate information to all classes of customers about risks underlying the financial products or services that are not readily apparent and which relate to the regulated Islamic banking service being provided.

- Cancellation and Withdrawals:

- The Bank will disclose in their terms of business the existence or absence of a right to cancel and must pay due regard to the interests of their customers and treat them fairly.

- Records:

- The Bank keeps sufficient records of client agreements and any documents referred to in the client agreement as soon as the agreement comes into force, for CBB’s supervision purposes.

- Best and Timely Execution:

- The Bank will take all reasonable steps to obtain, when executing orders, the best possible result for customers taking into account price, costs, speed, likelihood of execution and settlement, and any other consideration relevant to the execution of the order.

- The Bank will only postpone the execution of a transaction if it is in the best interests of the client, and the prior consent of the client has been given, or when circumstances are beyond its control. The Bank will maintain a record of all postponements together with the reasons for the postponement.

- Non-market Price Transactions:

- The Bank will not enter into a non-market price transaction in any capacity, with or for a client, if it has reasonable grounds to suspect that the client is entering into the transaction for an illegal or improper purpose.

- Aggregation and Allocation:

- The Bank will only aggregate an order for a client with an order for other clients, or with an order for its own account, where:

- It is unlikely that the aggregation will disadvantage the clients whose orders have been aggregated; and

- It has disclosed to each client concerned in writing that it may aggregate orders, where these work to the client’s advantage.

- Excessive Dealing:

- The Bank will not advise any client to transact with a frequency or in amounts that might result in those transactions being deemed excessive in light of historical volumes, market capitalisation, customer portfolio size and related factors.

- Right to Realise a Customer’s Assets:

- The Bank will not realise a client’s assets, unless it is legally entitled to do so, and has either:

- Set out in the terms of business:

- The action it may take to realise any assets of the customer;

- The circumstances in which it may do so;

- The asset (if relevant) or type or class of asset over which it may exercise the right; or

- Given the client written or oral notice of its intention to exercise its rights before it does so.

- Programme Trading:

- Before the bank executes a programme trade, it will disclose to its clients whether it will be acting as a principal or agent. The Bank will not subsequently act in a different capacity from that which is disclosed without the prior consent of the client.

- The Bank ensures that neither they, nor an associate, execute an own account transaction in any financial instrument included in a programme trade, unless they have notified the client in advance that they may do this, or can otherwise demonstrate that they have provided fair treatment to the client concerned.

- Confirmation of Transactions:

- The Bank has established procedures to keep the client informed of the essential details of the financial product or services when providing regulated banking services.

- Periodic Statements

- The Bank will promptly and at suitable intervals provide their clients with periodic statements on regulated Islamic banking services provided, throughout the duration of the contractual relationship between the bank and the client.

- In case of credit activities, the bank will provide periodic statements as required by the Code of Best Practice on Consumer Credit and Charging and in accordance with the CBB rulebook (Ref: Volume 2 – Business and Market Conduct Module BC-4.3).

- In case of investment activities, the bank will promptly and at suitable intervals provide their clients with a written statement when they:

- Undertake the activity of managing financial instruments; or

- Operate a client’s account containing financial instruments.

- Personal Account Transactions

- The Bank has established and maintains adequate policies and procedures, to ensure that:

- Employees involved with advising and arranging do not undertake a personal account transaction unless:

- The bank has, in a written notice, drawn to the attention of the employee the conditions upon which the employee may undertake personal account transactions and that the contents of such a notice are made a term of his contract of employment or services;

- The bank has given its written permission to that employee for that transaction or to transactions generally in financial instruments of that kind; and

- The transaction will not conflict with the bank’s duties to its clients;

- It receives prompt notification or is otherwise aware of each employee’s personal account transactions; and

- If an employee’s personal account transactions are conducted with the bank, each employee’s account must be clearly identified and distinguishable from other customers’ accounts.

- Inducements:

- The Bank has systems and controls, policies and procedures that ensure that neither they, nor any of their employees, offer, give, solicit or accept any inducement which is likely to conflict significantly with any duty that they owe to their clients.

- The Bank may only accept goods and services under a soft dollar agreement if:

- The goods and services do not constitute an inducement;

- The goods and services are reasonably expected to assist in the provision of regulated investment activities to the bank’s customers;

- The agreement is a written agreement for the supply of goods or services, and these goods and services do not take the form of, or include, cash or any other direct financial benefit; and

- The bank makes adequate disclosures regarding the use of soft dollar agreements.

- Before the Bank enters into a transaction for a client, either directly or indirectly, with or through the agency of another person, under a soft dollar agreement which the bank has, or knows that another member of its group has, with that other person, it must disclose to its customer:

- The existence of the soft dollar agreement; and

- The Bank’s or its group’s policy relating to soft dollar agreements.

- Client Complaints Procedure

Liquidity Management Centre is dedicated to provide their clients with the highest levels of satisfaction in delivering products and services; therefore in case of any concern or complaint you can submit a written complaint to the following address (download form):

Compliance Department

Liquidity Management Centre

Tel: +973 17 568 568

Fax: +973 17 911 055

Email: Complaints@lmcbahrain.com